This blog post aims to guide you through what you must do to ensure Medicare automatically forwards claims to secondary insurance. Additionally, we will explore whether the GA modifier is required for this process to occur.

Step 1: Complete the CMS 1500 Form Accurately

The first step is to fill out the insurance bill accurately. Ensure that all fields are completed correctly to avoid delays or denials.

Kalix has data scrubbing functionality, which will detect any errors before the claim is submitted.

Step 2: Indicate Secondary Insurance Coverage

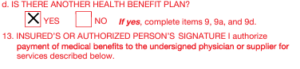

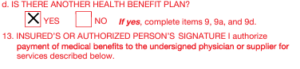

On the manual CMS 1500 form, Box 11D is crucial for indicating that the patient has other health insurance coverage besides Medicare. Here’s how to fill it out:

- Box 11D: Mark “YES” to indicate that the client has secondary insurance.

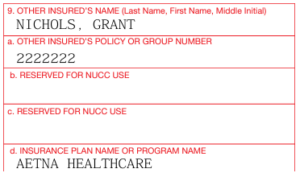

Step 3: Provide Detailed Secondary Insurance Information

Accurate and detailed information about secondary insurance is essential. Make sure to fill out the relevant sections with the following details:

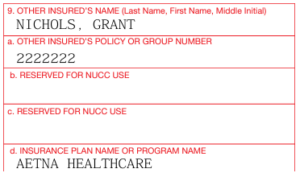

- Box 9: Name of the secondary insurance policyholder.

- Box 9A: Secondary insurance policy number.

- Box 9D: Name of the secondary insurance company.

If you are billing through Kalix, save the clients’ secondary insurance details to their profile. Better yet, request that clients fill out their insurance details for you through online scheduling or their intake forms. They can even upload photos of their ID and the front and back of their insurance cards.

Step 4: Submit the Claim to Medicare

After completing the CMS 1500 form, submit it to Medicare for processing. Ensure that all information is accurate and complete to avoid any delays.

Several methods exist to submit claims to Medicare, including the old-school paper submission (avoid using this method if possible) via your MAC’s Portal or billing software (often via a practice management solution like Kalix or a clearinghouse).

Note: MACs (Medicare Administrative Contractors) are regional organizations that process Medicare claims. You can find your designated MAC based on your location and the type of Medicare services you provide. A list of MACs can be found on the CMS website.

Kalix EMR makes the insurance submission process extremely easy by integrating directly with five leading clearinghouses: Assertus, Availity, Claim MD, Office Ally, and TriZetto. You can submit insurance claims to your chosen clearinghouses with just a click of a button without ever leaving Kalix.

Step 5: Medicare Processes and Forwards the Claim

Once Medicare processes the claim, it should automatically forward the necessary information to the secondary insurance company if Box 11D indicates secondary insurance coverage. This automatic forwarding is part of the coordination of benefits process, ensuring that the secondary insurance can cover any remaining eligible costs not paid by Medicare.

Step 6: Follow Up as Needed

After submitting the claim, it’s essential to follow up:

- Check Claim Status: Monitor the status of your claim with Medicare to ensure it is processed correctly.

- Secondary Insurance: Verify with the secondary insurance provider that they have received and are processing the forwarded claim.

If using Kalix, you can receive automatic claim status updates and electronic remittance advice against the bill in Kalix without ever leaving the program.

Part 2 – Understanding Modifiers and the GA Modifier

We often get asked if the modifier GA is necessary on an insurance claim for Medicare to send claims to secondary insurance. Let’s explore this topic further in the rest of this blog.

What is a Modifier?

Modifiers are two-character codes added to CPT (Current Procedural Terminology) or HCPCS (Healthcare Common Procedure Coding System) codes to provide additional information about the service or procedure performed. They help clarify specific aspects of the service, such as the context, extent, or reason for the service. They can affect the way a claim is processed and reimbursed by insurance companies, including Medicare.

What is the GA Modifier?

The GA modifier, “Waiver of Liability Statement Issued as Required by Payer Policy,” documents that a provider has informed a patient about their potential financial responsibility for services Medicare might not cover. This is particularly relevant when a provider anticipates that Medicare will deny a service as not necessary (we hope to explore this topic more in a future blog). The patient is issued an Advance Beneficiary Notice (ABN), indicating they assume financial responsibility.

However, it’s essential to note that the GA modifier is not necessary for Medicare to forward claims to secondary insurance. The primary mechanism for ensuring claims are forwarded appropriately is the correct completion of the CMS 1500 form. Key to this process is indicating the presence of secondary insurance coverage in Box 11D and accurately filling out other relevant fields that detail the patient’s secondary insurance.

It is a common misconception that the GA modifier must be used to facilitate the forwarding of claims from Medicare Part B to secondary insurance. However, this is not the case. The GA modifier’s role is more about documentation and communicating the patient‘s financial responsibility for non-covered services. While modifiers like GA provide important information about the services rendered and document specific interactions regarding financial responsibility, they are not required for the claim forwarding process.

Conclusion

By accurately completing the CMS 1500 form and indicating secondary insurance coverage, you can ensure that Medicare Part B automatically forwards your claims to secondary insurance. This helps streamline the billing process and reduces the financial burden on patients. Always double-check your forms for accuracy and follow up as needed to ensure smooth processing of your claims. Remember, while modifiers are important for providing detailed information about the services provided, the GA modifier is not specifically required for the claim forwarding process.

Kalix, is designed to simplify your insurance billing process, making it easier for you to manage Medicare and secondary insurance claims efficiently. For more information on how Kalix can help streamline your billing operations, visit our website.